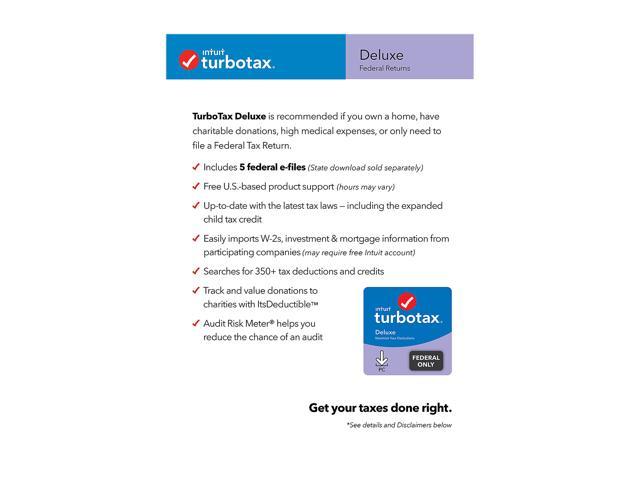

The company made some unpopular changes to its tax return software this year, which has resulted in a customer backlash that has dropped 2014 TurboTax Deluxe software to a meager 2-star rating on Amazon. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.įor more information about backup withholding requirements, visit IRS.gov. We'll also begin 24% backup tax withholding on your Robinhood Securities account. You'll be able to hold and sell your positions, but you'll be restricted from buying and depositing funds. The warning applies to your Robinhood Securities and Robinhood Crypto accounts : We'll restrict both accounts to position-closing orders until the warning is resolved. Additionally, we'll restrict your account to position-closing orders.

That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding. The warning only applies to your Robinhood Securities account : We'll begin 24% backup tax withholding until the warning is resolved. If the required documentation is not submitted by the deadline provided in the warning and. You'll receive a prompt to complete this step in the app if applicable. If we receive a second B-Notice from the IRS regarding your account, we'll email you with a different set of steps to resolve the warning-you'll need to upload a photo of your Social Security card instead.

We'll send you the form by email from or with the subject line "Action required: Complete the IRS W-9 form." You can complete this process without a DocuSign account. If you receive an email from us letting you know we received a first warning for your account, you'll need to complete a W-9 form to satisfy the IRS requirements. You’ll get a backup withholding warning (B-Notice) if the name and/or taxpayer identification number (Social Security number) on your Robinhood account doesn't match the name and number combination that the Internal Revenue Service (IRS) or Social Security Administration has on record for you.

0 kommentar(er)

0 kommentar(er)